Cash Flow for People Who Think Spreadsheets Are a Personality Type

Profit doesn’t pay your bills — cash does. This guide breaks down how to manage cash flow without needing a finance degree or fancy software.

Published under The Accounting Hat on HatStacked.com

If you’ve ever had money in your account but still felt broke, this post is for you. Welcome to the magical, maddening world of small business cash flow — where profit is not cash, timing is everything, and spreadsheets haunt your dreams.

Wait, Why Am I Profitable But Always Broke?

It’s the most frustrating riddle in business:

- You’re selling things.

- You’re invoicing people.

- The books say you made a profit.

But you’re still staring at your checking account thinking, “Where’s all the money?”

The answer is cash flow — and it’s not the same as profit.

Cash Flow 101: The Non-Boring Definition

Cash flow is how money moves in and out of your business over time.

- Positive cash flow means more is coming in than going out. Nice.

- Negative cash flow means you’re burning cash faster than it’s arriving. Stressful.

- Neutral cash flow means you’re treading water. Sustainable, but not scalable.

And unlike profit, which shows on paper, cash flow shows in your bank account.

Why Cash Flow Actually Matters More Than Profit

You can be “profitable” and still:

- Bounce payroll

- Miss vendor payments

- Get hit with overdraft fees

- Delay inventory reorders

- Lose sleep and consider selling your truck

Cash keeps the lights on. Profit is a concept.

You pay bills with cash, not accounting theory.

Common Small Biz Cash Flow Killers

Let’s call them out:

❌ Waiting Too Long to Invoice

You send the invoice three weeks late, and the client pays two weeks after that. That delay compounds fast.

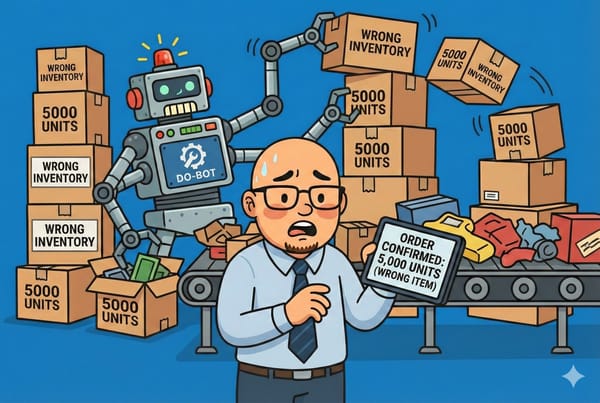

❌ Inventory Glut

You stocked up for a big order… that still hasn’t come in.

❌ Recurring Subscriptions You Forgot You Had

SaaS bloat is real. $59 here, $99 there, and suddenly your cash flow is a slow leak.

❌ No Payment Terms Enforcement

You let everyone pay “whenever,” and guess what? They do.

❌ Ignoring Seasonality

You forget that July is dead and spend like it’s December.

The Cash Flow System You Actually Need (No MBA Required)

You don’t need to build a full financial model. You need something simple and repeatable.

Here’s the baseline system:

✅ Step 1: Track Weekly Cash Flow

Use Google Sheets or Excel — just two columns: money in, money out. Do it weekly.

| Week | Inflows | Outflows | Net Cash |

|---|---|---|---|

| July 1 | $4,200 | $3,100 | $1,100 |

| July 8 | $2,800 | $4,500 | -$1,700 |

✅ Step 2: Forecast the Next 4–6 Weeks

Base it on invoices issued, bills due, and expected sales. Highlight weeks where cash goes negative.

✅ Step 3: Flag Timing Issues

Do you have a big outflow before your next inflow? That’s where problems happen. Even if the month ends in profit, mid-month could wreck you.

✅ Step 4: Build a Cash Cushion

Aim for 1–2 months of fixed expenses in reserve. That gives you runway when clients are slow or emergencies happen.

Tools That Help (Without Making You Hate Everything)

You don’t need to go full ERP. These tools make cash flow tracking less painful:

- QuickBooks Online — cash flow dashboard, forecasts, and linked banking

- Xero — beautifully designed and strong on cash flow reports

- Float — visual cash forecasting, syncs with QBO and Xero

- Dryrun — good for “what-if” cash flow scenarios

If you want no software at all? Stick to Google Sheets and manual updates. It still works.

Simple Ways to Improve Your Cash Flow Immediately

You don’t need to make more money to have more cash. Sometimes it’s about speeding up what you’re owed and slowing down what you spend.

🔼 Speed Up Inflows:

- Invoice the moment work is delivered

- Set clear payment terms (e.g., Net 7, not Net 30)

- Add payment links for faster pay (PayPal, Stripe, QuickBooks)

- Charge late fees (and enforce them)

- Offer small discounts for early payment

🔽 Slow Down Outflows:

- Ask vendors for longer terms

- Pause unnecessary tools or subscriptions

- Batch order to reduce shipping costs

- Delay large purchases until after key receivables clear

What We Do (Because We’ve Screwed This Up Before)

We’ve had months where our P&L looked great, but our checking account was crying.

Now we:

- Forecast cash every Monday (10-minute habit)

- Set internal due dates earlier than actual ones

- Have automated payment reminders set up in QBO

- Use UptimeRobot to monitor your online store — because downtime = losing cash

- Keep 2 months of payroll in reserve, minimum

It’s not fancy, but it keeps the panic at bay.

If You Only Do Three Things:

- Start tracking cash weekly — even on paper

- Know when you’re going negative before it happens

- Build a cushion, even if it’s $200 at a time

It’s not about perfection. It’s about visibility.

Final Thoughts: You’re Not Bad at Money, You’re Just Busy

Most business owners aren’t accountants. You don’t need to be.

You just need to see your numbers, react early, and plug leaks before they drain you dry.

Once you get in the rhythm of tracking and forecasting cash flow, it stops feeling scary. It starts feeling like control.

And in business, control is power.

Want More Posts Like This?

📬 Join the HatStacked Newsletter

Daily tips, tools, and insights to make your small business feel a little less chaotic.

Subscribe